Duplicate 1099/Taxable Earnings Summary Release Form 2011-2025 free printable template

Show details

Print Form DUPLICATE 1099/Taxable Earnings Summary Release Form Instructions 1. Indicate if you are requesting a Taxable Earnings Summary TES or duplicate 1099. Date This is to request that my for the year and/or month of be faxed/emailed to me at Active Associates may request information to be faxed or emailed. However only an Aflac.com email address will be utilized for emailing the information I understand that by requesting this material to be faxed or sent to a personal email address I...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign Duplicate 1099Taxable Earnings Summary Release Form

Edit your Duplicate 1099Taxable Earnings Summary Release Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Duplicate 1099Taxable Earnings Summary Release Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Duplicate 1099Taxable Earnings Summary Release Form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Duplicate 1099Taxable Earnings Summary Release Form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Duplicate 1099Taxable Earnings Summary Release Form

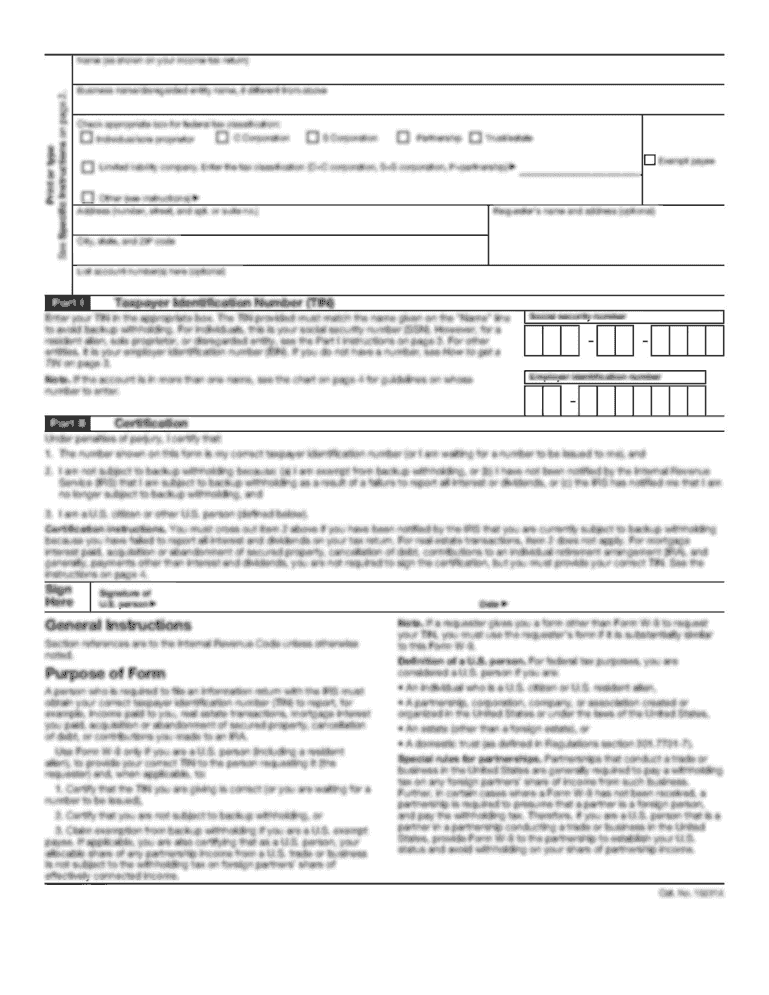

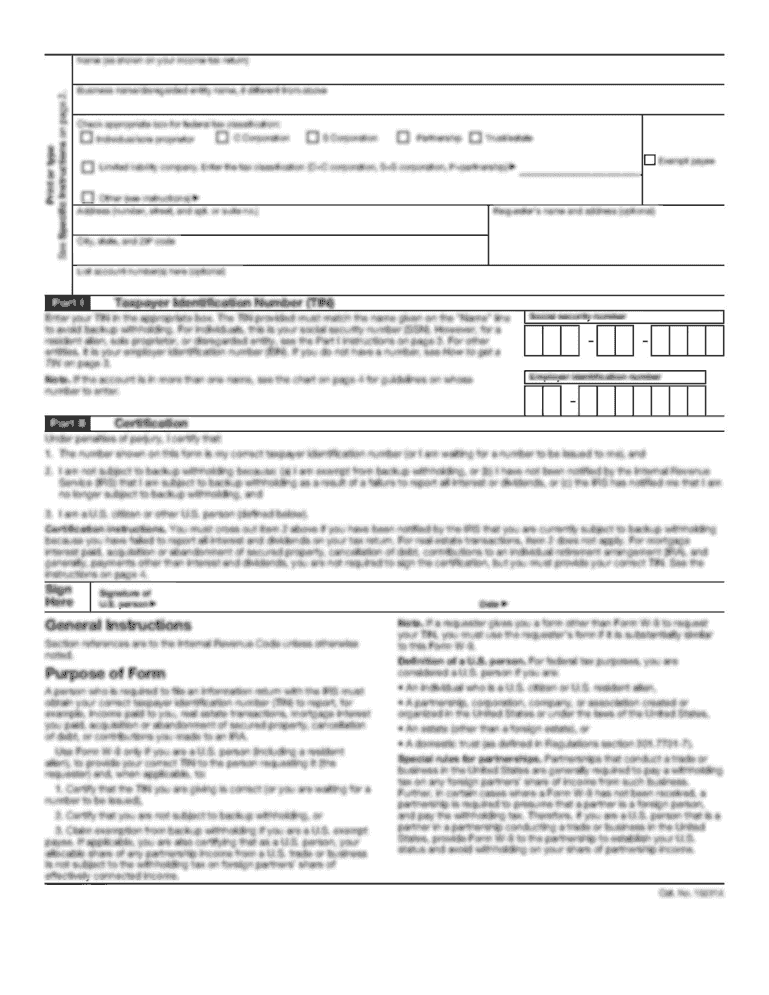

How to fill out Duplicate 1099/Taxable Earnings Summary Release Form

01

Obtain the Duplicate 1099/Taxable Earnings Summary Release Form from the IRS or your employer's HR department.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security Number.

03

Specify the tax year for which you are requesting a duplicate 1099 form.

04

Indicate the reason for requesting a duplicate, such as 'lost form' or 'incorrect information'.

05

Review the instructions on the form for any additional requirements or documentation needed.

06

Sign and date the form, certifying that the information you provided is accurate.

07

Submit the completed form to the appropriate IRS office or your employer as instructed.

Who needs Duplicate 1099/Taxable Earnings Summary Release Form?

01

Individuals who have lost their original 1099 form.

02

Taxpayers who find errors on their original 1099 form and need the corrected version.

03

People who require a duplicate for tax reporting purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I check my Aflac claim status?

Log in to your account to check the status of your claim. From there, you'll be able to check claim status, upload additional supporting documents if needed, and view your explanation of benefits. You may also check claim status by chat or phone by calling us at 800.992.3522.

How much does Aflac pay for claims?

Cost Calculator Accidentup to $2,450Hospitalup to $2,450Short-Term Disabilityup to $2,720Critical Care & Recoveryup to $9,859Cancer/Specified-Diseaseup to $9,859

How do I pay my Aflac bill?

How can I pay my Aflac bill? You can pay them directly on this website. Or pay on doxo with credit card, debit card, Apple Pay or bank account.

How do I make a payment to Aflac?

Log in to your account, go to the My Account page and click Aflac Always. From there, select the policies you want to protect, choose when and how to pay your premiums, provide your autopayment method of choice (i.e., bank account or credit card), and you're done!

How does Aflac payout work?

Aflac pays cash benefits directly to you, unless otherwise assigned. This means that you will have added financial resources to help with expenses incurred due to medical treatment, ongoing living expenses or any purpose you choose.

How long does it take to get claim money from Aflac?

Most claims are processed in about four business days. But it doesn't stop there. The Accident Insurance plan from Aflac means that your family has access to added financial resources to help with the cost of follow-up care as well.

Can I pay my Aflac bill online?

Log in to your account, go to the My Account page and click Aflac Always. From there, select the policies you want to protect, choose when and how to pay your premiums, provide your autopayment method of choice (i.e., bank account or credit card), and you're done!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is duplicate1099 aflac com?

There is no information available on the website "duplicate1099.aflac.com" as it does not seem to be a legitimate or official Aflac website. It is advised to be cautious when accessing such websites and to ensure you are on the official Aflac website to avoid potential scams or fraudulent activity.

How to fill out duplicate1099 aflac com?

To fill out a duplicate 1099 form with Aflac, you can follow these steps:

1. Visit the Aflac website or contact their customer service to request a duplicate 1099 form. Aflac will typically provide a link or send you a physical form to fill out.

2. Download or print out the 1099 form if it is available online. If you receive a physical form, ensure that it is legible and easy to fill out.

3. Gather the necessary information to complete the form. This includes your personal information, such as your name, address, and Social Security number. Additionally, you will need the details of the income you received from Aflac, including the amount, type of income, and any applicable taxes withheld.

4. Use the information from your original 1099 form as a reference to accurately fill out the duplicate. Make sure to transfer all the information correctly to avoid any discrepancies.

5. Verify that all the information you have entered is accurate and complete. Double-check for any mistakes or missing details before submitting the form.

6. Sign and date the form. Be sure to do this in the designated spots provided on the form.

7. Submit the duplicate 1099 form to Aflac using the method specified by them. This may involve mailing the form to a specific address or submitting it electronically through their website.

8. Retain a copy of the duplicate 1099 form for your records. This will be useful for tax-filing purposes and will serve as proof of the income you received.

Note: It is always a good idea to consult with a tax professional if you have any uncertainties or questions about filling out tax forms.

What is the purpose of duplicate1099 aflac com?

The purpose of duplicate1099.aflac.com is to provide a platform for Aflac policyholders or beneficiaries who may have misplaced or lost their original 1099 tax form to request a duplicate copy. 1099 forms are used to report various types of income, such as interest, dividends, or non-employee compensation, to the Internal Revenue Service (IRS) for tax purposes. By visiting duplicate1099.aflac.com, users can enter the necessary information to request a duplicate 1099 form from Aflac, ensuring accurate reporting of their income for tax filing.

How can I edit Duplicate 1099Taxable Earnings Summary Release Form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your Duplicate 1099Taxable Earnings Summary Release Form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send Duplicate 1099Taxable Earnings Summary Release Form to be eSigned by others?

When you're ready to share your Duplicate 1099Taxable Earnings Summary Release Form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit Duplicate 1099Taxable Earnings Summary Release Form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing Duplicate 1099Taxable Earnings Summary Release Form, you need to install and log in to the app.

What is Duplicate 1099/Taxable Earnings Summary Release Form?

The Duplicate 1099/Taxable Earnings Summary Release Form is a document issued to taxpayers to provide a summary of taxable earnings that have been reported in duplicate, often used when the original 1099 form is lost or needs to be corrected.

Who is required to file Duplicate 1099/Taxable Earnings Summary Release Form?

Individuals or businesses that have previously filed a 1099 form and need to amend their records, or those who need to issue a replacement due to a lost or incorrect 1099 form, are required to file the Duplicate 1099/Taxable Earnings Summary Release Form.

How to fill out Duplicate 1099/Taxable Earnings Summary Release Form?

To fill out the Duplicate 1099/Taxable Earnings Summary Release Form, provide the taxpayer's identification information, fill in the details of taxable earnings, specify the type of income, and include any corrections or notes explaining the reason for the duplicate.

What is the purpose of Duplicate 1099/Taxable Earnings Summary Release Form?

The purpose of the Duplicate 1099/Taxable Earnings Summary Release Form is to ensure that the IRS has accurate and complete information regarding taxable earnings, especially in cases where the original form is not sufficient or has been misplaced.

What information must be reported on Duplicate 1099/Taxable Earnings Summary Release Form?

The information that must be reported on the Duplicate 1099/Taxable Earnings Summary Release Form includes the taxpayer's name, taxpayer identification number, total taxable earnings, type of income, and any necessary explanations for the duplicate issuance.

Fill out your Duplicate 1099Taxable Earnings Summary Release Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Duplicate 1099taxable Earnings Summary Release Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.